Research & Publications

- All

- Climate Action

- Decommodification

- Ed Broadbent Digital Archive

- Empowering Workers

- Innovation for All

- Public Opinion

- Rights & Democracy

-

Workplace Democracy for the 21st Century: Towards a New Agenda for Employee Voice and Representation in Canada

In this discussion paper, we make the case for a renewed national dialogue on 'workplace democracy'; advancing the fundamental rights of employees to associate freely and to have some say…

-

Housing Costs and Labour since the 1970s

There exists a number of indices that look at the price of housing by deflating the nominal dollar price of a house by the consumer price index (CPI) to get…

-

A Green Entrepreneurial State as Solution to Climate Federalism

This paper argues that Canada should look beyond “market-based” climate strategies to resolve climate federalist challenges. A policy mix more targeted towards specific technology systems can tailor approaches to Canada’s…

-

An Electoral System for All: Why Canada Should Adopt Proportional Representation

We can choose a system that will serve and represent Canadians fairly and equally while better engaging them in the political process. And that’s a system based on proportional representation.

-

An Analysis of the Economic Circumstances of Canadian Seniors

This report analyzed the retirement savings of near-retirement Canadians ages 55 to 64 without a workplace pension. The results are startling — and explain why seniors' poverty is set to…

-

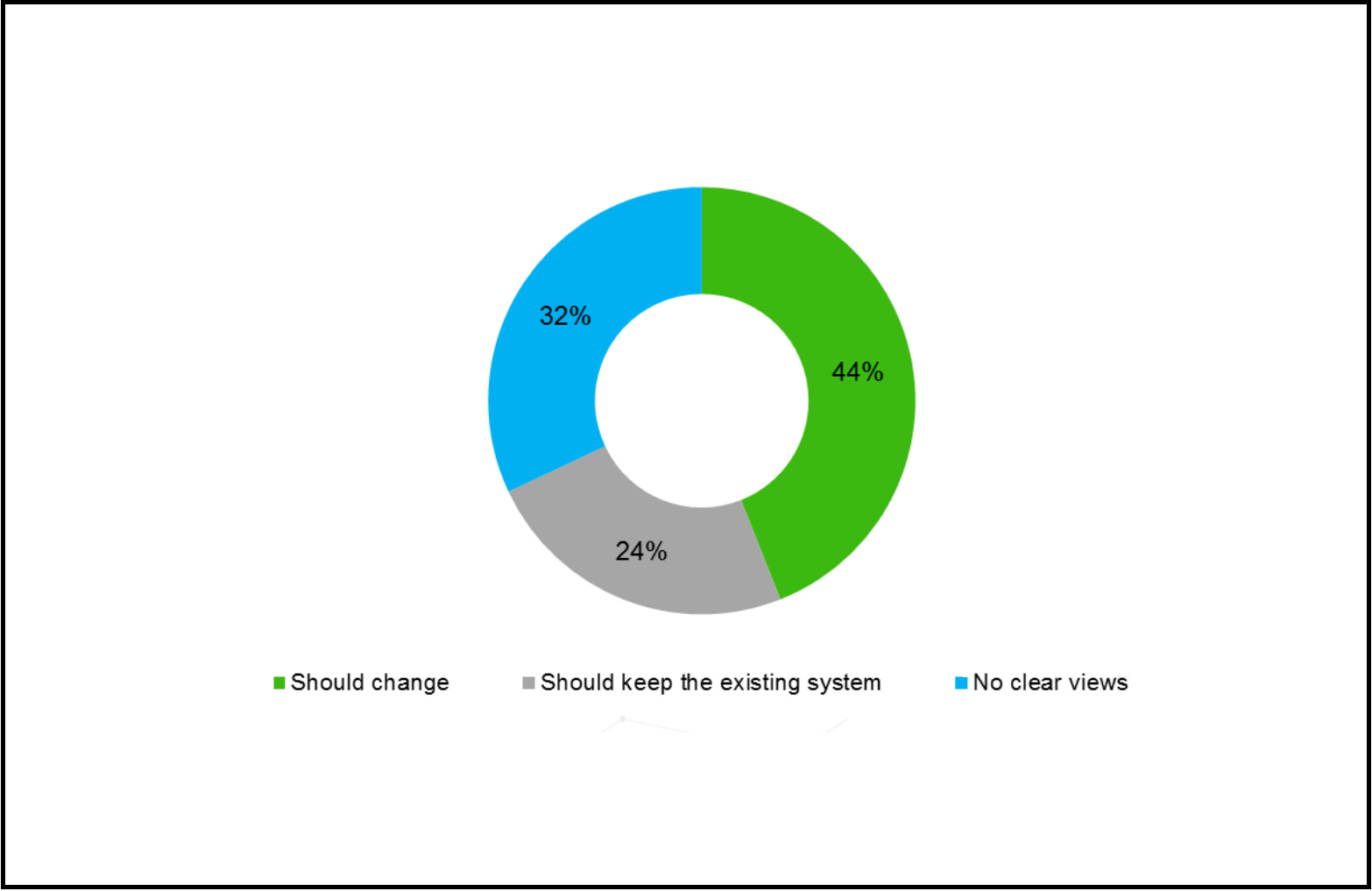

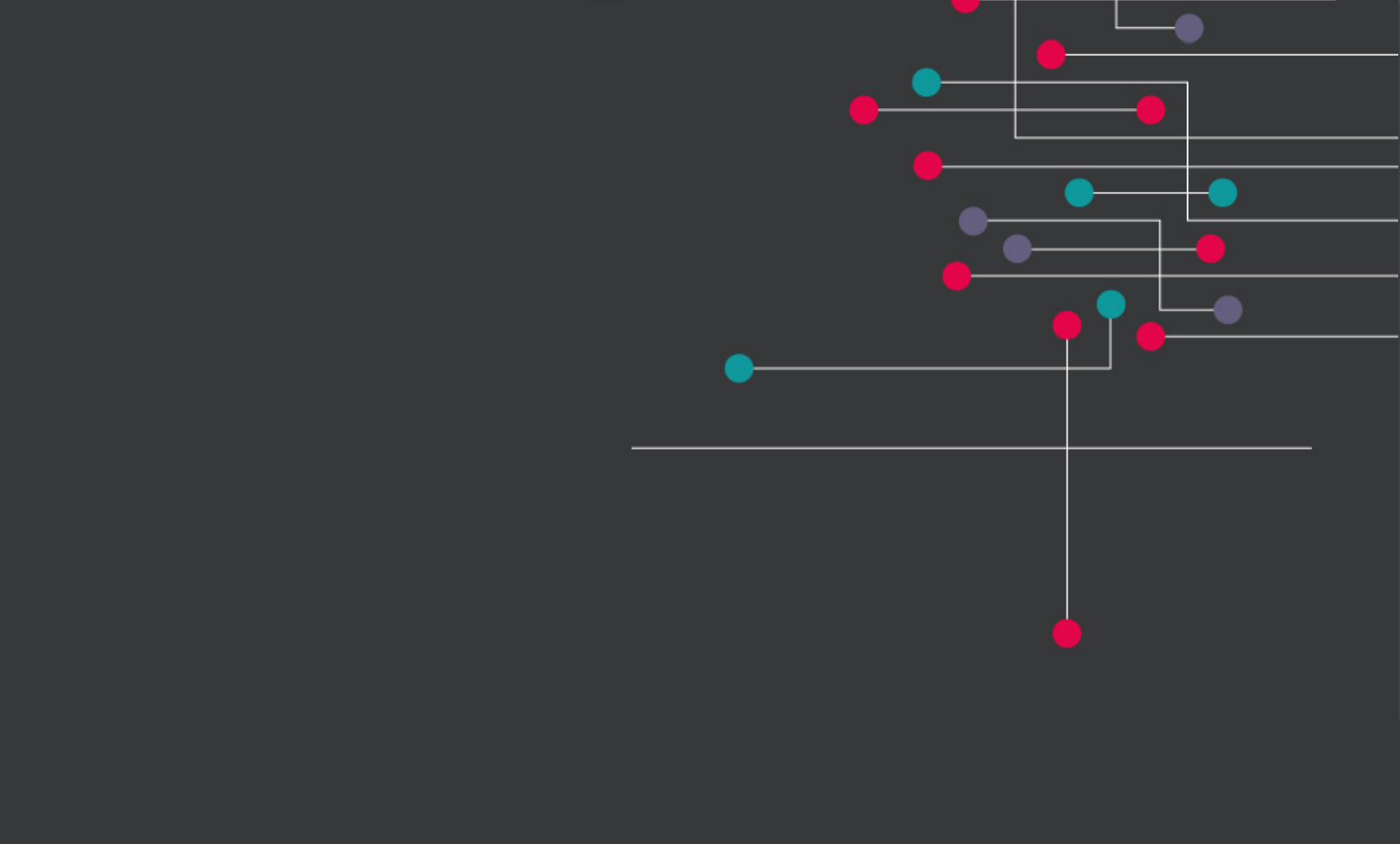

Canadian Electoral Reform: Public Opinion on Possible Alternatives

This is the first study of its kind and size to measure Canadians' attitudes about voting system design and preferences for electoral reform. It also estimates what the outcome of…

-

Climate, Health, and Alberta’s Coal-Fired Power Plants

This report is a submission to the Alberta Climate Change Advisory Panel. It provides important evidence supporting the accelerated phase-out of the province’s coal-fired electricity generation.

-

Right-leaning Charities Continue to Claim 0% Political Activity to CRA

This report analyzes the 2014 filings of 10 right-leaning charities. It reveals that nine out of 10 again claim 0% political activity in their 2014 submissions to the CRA.

-

The Economic Benefits of Public Infrastructure Spending in Canada

This report provides estimates of the economic benefits of a five-year, $50-billion public infrastructure spending program in Canada funded equally by the federal and provincial governments.

-

The Millennial Dialogue Report

Canadian millennials have little confidence in politicians and are even more jaded than their American counterparts are about

-

Could a Progressive Platform Capture Canada’s Youth Vote?

More young Canadians back a progressive agenda than older Canadians, according to a new study of massive dataset of over 8,000 Canadians. So could a progressive platform capture Canada's youth…

-

Step Change: Federal Policy Ideas Toward a Low-carbon Canada

Canada must calibrate its climate policies with a view to the long term. In addition to carbon pricing — a core policy idea that is gaining ground at the provincial…