Research & Publications

- All

- Climate Action

- Decommodification

- Ed Broadbent Digital Archive

- Empowering Workers

- Innovation for All

- Public Opinion

- Rights & Democracy

-

Medicare 2.0

This research paper urges the government to expand public health care and outlines why it is critical to do so now, during COVID-19, calling for establishing comprehensive mental health services,…

-

Most Canadians Want to See Bold New Ideas in Post-COVID Recovery Agenda

A majority of Canadians (54 per cent) want to see the federal government announce bold new ideas for how to fundamentally improve people’s lives and deal with climate change in…

-

The Missing Money Our Schools Need Now: Education Development Charges in Toronto

The current provincial regulation governing whether or not a school board can charge Education Development Charges means that developers in Toronto get away without paying one cent to TDSB schools.…

-

Economic Recovery: Getting it Right for Women and Families in Ontario

Canada requires a comprehensive strategy for economic recovery that helps workers re-establish and maintain attachment to the workforce, ensures adequate income for all, and supports inclusion and gender equity.

-

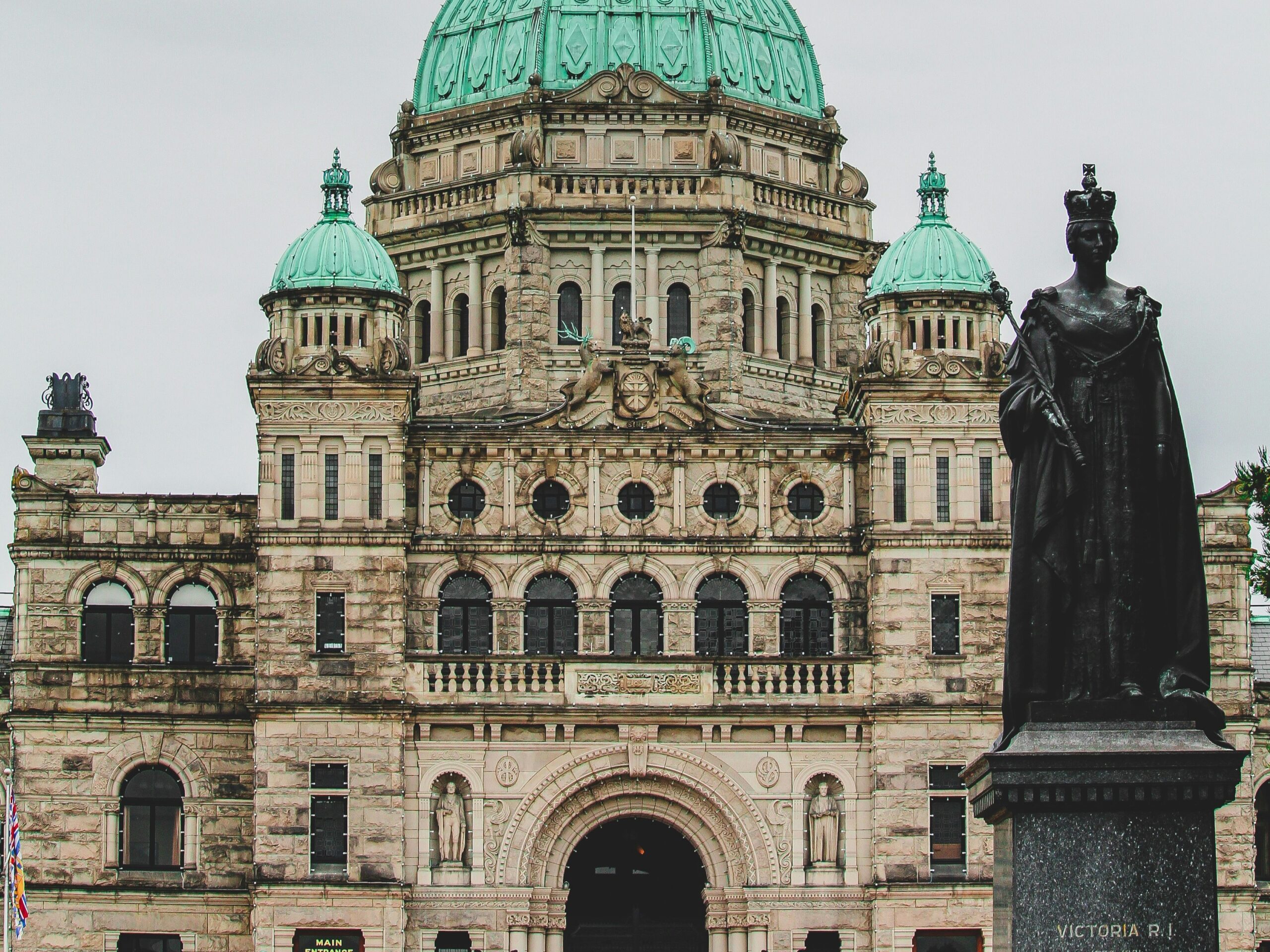

Building British Columbia’s Recovery, Together: Proposals for a Just Recovery

We have an opportunity through the recovery process to not only get British Columbia’s economy moving again, but to ensure it moves in the right direction.

-

Basic Income: An Explainer by Guy Caron

In this explainer, Guy Caron reviews Basic Income, how Basic Income differs from social assistance and disability benefits.

-

Multi-Millionaires and Fair Taxes: The Case for a Wealth Tax in Canada

Our latest survey shows that the majority of Canadians are looking for a COVID-19 recovery plan that is fair, inclusive and compassionate, leaving no one behind, and 8 out 10…

-

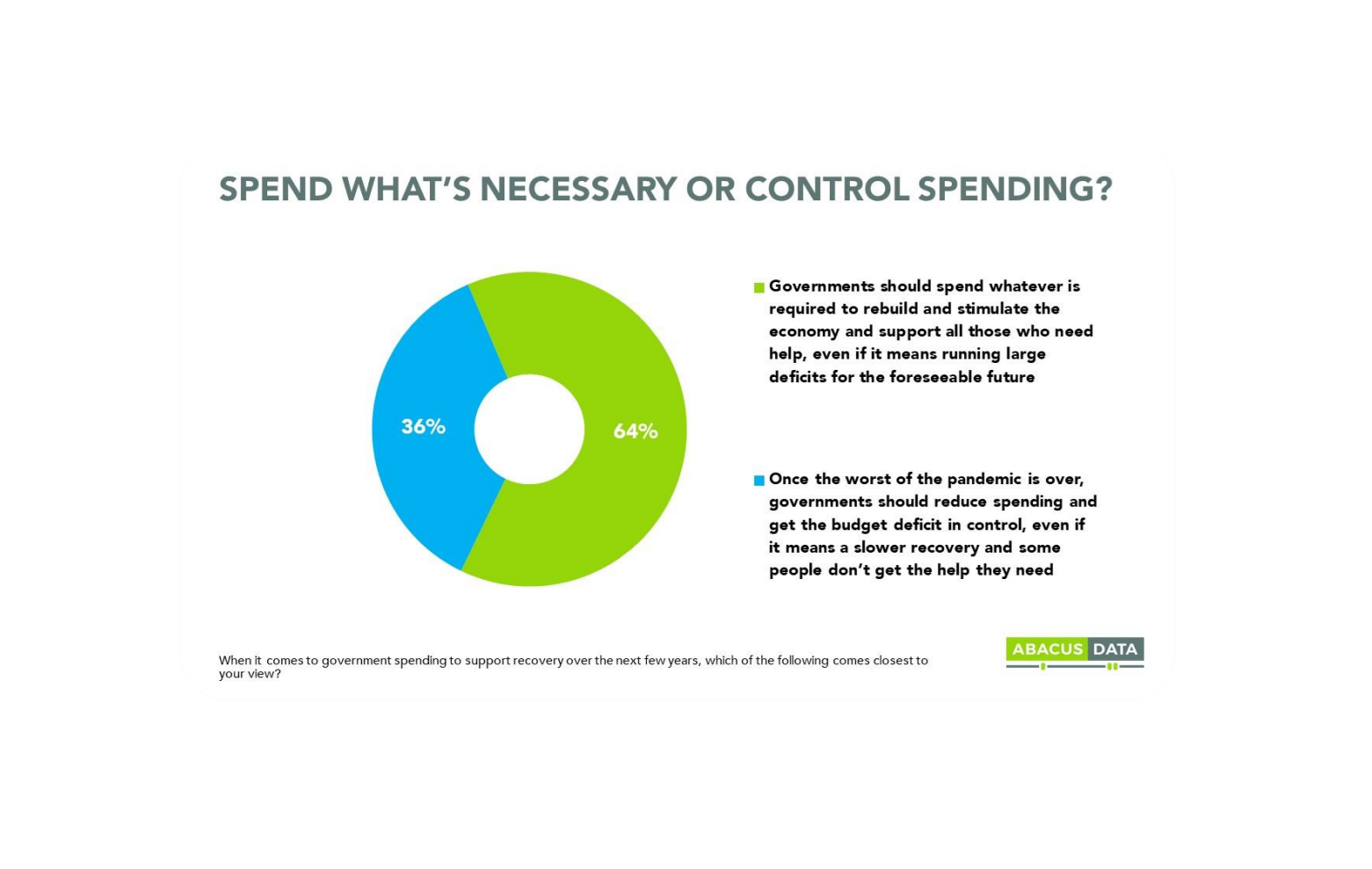

What Kind of Economic Recovery do Canadians Want?

Canadians want a recovery that is fair and ensures the richest among them contribute and pay their share. A recovery that helps make Canada more self-sufficient and strengthens the public…

-

Filthy Five: Canada’s Tax Loopholes, Part 2

In 2018, the Broadbent Institute identified the five worst tax loopholes in Canada’s tax system. Little has been done to address these loopholes, which still drain money out of the…

-

Post-Election Co-operation, 2019

On October 21, 2019, Canadians elected a Liberal minority government, creating the potential for the NDP to be a key player in parliament. Like all minority governments, cooperation across party…

-

Big Data and Criminal Justice: What Canadians Need to Know

We outline what ‘big data’ is, how it is used in the context of criminal justice in Canada and beyond, and how we might think about the potential beneficial and…

-

The Affordability Equation: How a Rising Concern About the Cost of Living Presents a Threat and Opportunity to Progressives

Concerns about cost of living, wages, and affordability have been an important part of Canada’s political discourse for many years. But we felt something was happening. Canadians seem to be…